Passive

“I want to live a passive life.” - No one, ever.

Have you ever seen the movie, “The Princess Bride”?

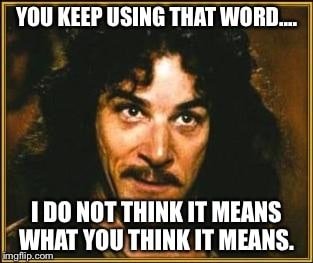

It is brilliant, in so many ways. One phrase in particular lives in my head: “You keep using that word. I do not think it means what you think it means.” Inigo Montoya, like so many of us, hears a word that doesn’t quite fit and as a result, calls foul.

Inigo, I feel you.

Recently, the word “passive” has come up in different contexts: comparing passive investing to active investing, passive income when referring to investment real estate, or to losses on a tax return.

Pop quiz: one (and only one) of the choices below has real, concrete meaning:

(A) Passive Investing

(B) Passive Income

(C) Passive Losses

It’s high time to eliminate the word “passive”. Life is not passive, and we are kidding ourselves if we set a goal around some kind of “passive” approach.

“Passive” Investing

Investing isn’t passive. An investor can use index funds or ETFs, or can buy and hold individual securities, but there is nothing passive about this process. Investments require a coherent strategy and regular monitoring. However, it doesn’t have to be complex or overwhelming. Investing is like planting a garden. Once you’ve planted, nature does the growing, but you need to water, weed, and occasionally fertilize. Not every day, or every minute, but some attention is required. Gardening isn’t passive and neither is investing.

“Passive” Income

When I hear people talk about building passive income through real estate, that’s my first clue that the people speaking probably don't own investment real estate. Unless it’s a managed real estate investment program, there is nothing passive about owning a rental. Even with the help of a good property manager, investment real estate requires attention. A very smart advisor specializing in real estate says owning investment real estate is essentially running a business. Ask any business owner how passive that undertaking is!

“Passive” Losses

This is the only term that has real meaning. The IRS has specific criteria for the deductibility of losses, and whether the losses are “passive” or “active”. This has a significant impact on a person’s tax liability. If you have a trade or business, or if you have pass-through losses from investments, this is an important concept for you.

If you picked “C”, great job!

Who (and what) does “Passive” Serve?

If something is passive, it’s not really a concern, right? It means you can direct your attention elsewhere. Labeling something “passive” is an excellent approach if the goal is to decrease attention: to fees, to mediocre performance, to exercising control.

One of my favorite analogies for this is housekeeping. There is no “passive” approach for cleaning a house. You can do it yourself, or you can pay for a cleaning service. Either way, the work gets done. The cost is either your time (which has a value) or the amount you pay a housecleaner. It’s not free, and it certainly isn’t passive.

“Passive” Life?

The funny thing about this word is I never hear anyone use it in the context of the life they want to live. Not one client I have ever worked with has ever said, “Oh yes, I aspire to be passive. Let someone else tell me what to do.”

Aren’t we all simply striving to budget the attention we have to the things that matter most? Your money and financial landscape are important. It matters and requires your attention. Whether you learn how to do it on your own or engage the services of a professional, it takes time and energy to manage. This time and energy is monetized if you hire a pro - there is a fee for service. You get to decide if it’s worth it.

Bring intention, pay attention, stay active.

Life isn’t passive.

“Anyone who says differently is selling something.” - Westley, The Princess Bride